Client Resources

Quick access to everything you need: your secure portal, refund tracking, payment options, and ways to reach me.

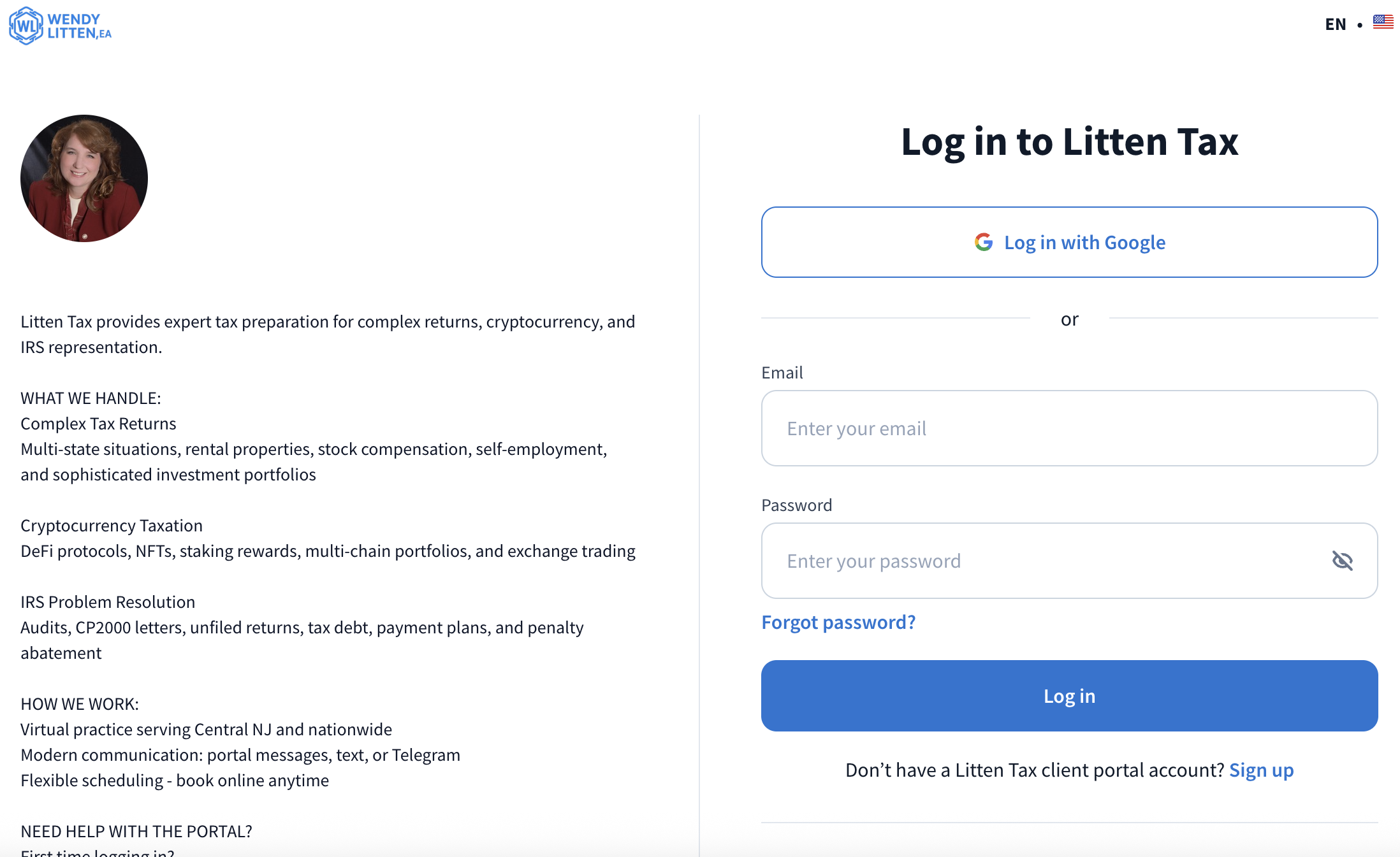

Client Portal

Access your secure client portal for documents, messages, and tax information.

Check Your Refund Status

Federal Tax Refund

Track your federal tax refund with the IRS. You'll need your Social Security Number, filing status, and exact refund amount.

State Tax Refund

Select your state to check your state tax refund status:

Make a Tax Payment

Need to pay Federal taxes? Here are your options:

IRS Direct Pay - Free, secure payment directly from your bank account. No registration required.

EFTPS - Electronic Federal Tax Payment System. Schedule payments in advance, track payment history. Requires enrollment.

IRS Online Account - Your IRS account lets you make payments, view your balance, check payment history, access tax transcripts, and see your tax records. If we're working together on IRS representation, this is also where you can authorize me to access your account - making the process faster and easier.

Contact Me

Text: 732-4-LITTEN (732-454-8836)

Email: taxes@wendylitten.com

Telegram: @LittenTax

Schedule a Call: Book your 15-minute discovery call

Portal: Message me anytime through your client portal

Fax: (888) 831-8011 (Yes, the IRS still uses fax)

I respond to texts, Telegram, email, and portal messages. Business days, I'm usually back to you within a few hours.Recent Articles

Stay informed with tax updates, tips, and guidance:

- Multi-State Tax Filing: When You Need Professional Help

- Cryptocurrency Tax Preparation: A Complete Guide

- What Is Form 1099-DA?

- What's New for 2026 Tax Season

Tax Calendar

2026 Tax Deadlines & Important Dates

January

🌐 Jan 1 -- FBAR (FinCEN 114) available for filing

⏰ Jan 15 -- Q4 2025 estimated tax payment due

📊 Jan 31 -- W-2s and 1099-NEC due to recipients and IRS

📊 Jan 31 -- Other 1099s due to recipients

₿ Jan 31 -- 1099-DA expected from digital asset brokers (digital assets)

February

📊 Feb 2 -- W-2s due to employees (Copy B)

📊 Feb 28 -- Paper 1099s due to IRS

March

🏢 Mar 16 -- S-Corp & partnership returns due (Forms 1120-S, 1065)

📊 Mar 31 -- E-filed 1099s due to IRS

April

📝 Apr 15 -- Individual tax returns due (Form 1040)

⏰ Apr 15 -- Q1 2026 estimated tax payment due

💡 Apr 15 -- IRA & HSA contribution deadline for 2025

🏢 Apr 15 -- C-Corporation returns due (Form 1120)

🌐 Apr 15 -- FBAR due (automatic extension to Oct 15)

May

💼 May 15 -- Tax-exempt organization returns due (Form 990, calendar year)

June

⏰ Jun 16 -- Q2 2026 estimated tax payment due

September

⏰ Sep 15 -- Q3 2026 estimated tax payment due

🏢 Sep 15 -- S-Corp & partnership returns due (if extended)

October

📝 Oct 15 -- Individual tax returns due (if extended)

🏢 Oct 15 -- C-Corporation returns due (if extended)

🌐 Oct 15 -- FBAR due (extended deadline)

💼 Oct 15 -- Tax-exempt organization returns due (if extended)

December

💡 Dec 31 -- Last day for most tax planning moves

₿ Dec 31 -- Crypto tax-loss harvesting cutoff

Legend

📝 Individual returns

🏢 Business returns

⏰ Estimated payments

🌐 International / FBAR

💼 Other business / nonprofit

📊 Information reporting

₿ Crypto-specific

💡 Planning opportunities

Notes

- Deadlines falling on weekends or federal holidays move to the next business day

- Most deadlines shown are for calendar-year filers

- Fiscal-year filers have different due dates

- FBAR applies to qualifying foreign financial accounts, including certain foreign custodial crypto accounts (not self-custody wallets)

- Dates are based on current law and guidance; future changes are possible -- check back annually